After you or your family member visit a healthcare provider, including your doctor, lab, hospital or other facility, the office will usually submit a claim to your insurance company for payment. Once the insurance company has paid their agreed-upon portion, the provider will then send you a statement indicating the remaining charges you are responsible for. This could include your copayment, coinsurance, or the full amount agreed-upon by the insurance company and provider if you have not yet met your deductible.

But how do you know if the amount the provider is charging you is correct? It’s important to understand how to read your medical bills so you can determine if it is accurate before you make a payment. Below are the primary components you will likely encounter when reviewing your medical bills:

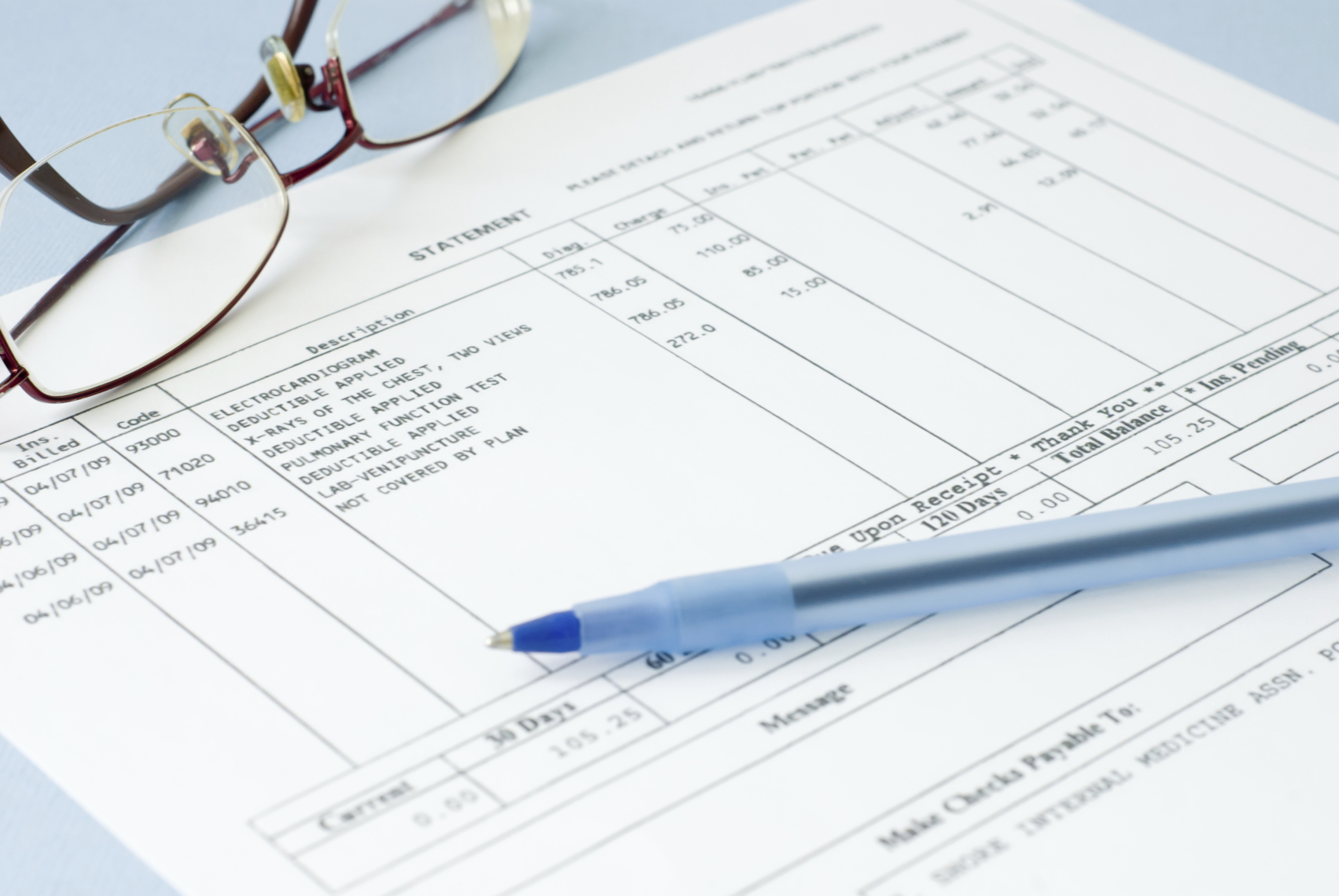

Date of Service – Indicates the date of your appointment or when services were provided. If you had multiple services done during a visit, you may see the date repeated for each individual procedure. Additionally, if you had testing or lab work done, the date may be later than your appointment if someone processed or reviewed your results following your appointment. Review the dates on your bill to ensure they make sense based on when you visited the provider and what services they provided.

Member – The bill will typically note who received the service, whether it was you or a family member.

Description of Service – This is a brief description of the service or procedure you or your family member received, such as an office visit or a specific lab test. If the service listed seems unfamiliar or incorrect, contact your provider’s office to verify.

CPT Codes – Along with the description of service will often be a Current Procedural Terminology, or CPT, code. This five-digit number corresponds to the service or procedure you received, helping your insurer determine how much they will pay the provider (and in turn, how much the provider will bill you). While CPT codes on their own may be difficult to verify, reviewing them along with the Description of Service can help identify any potential red flags or errors. You can also compare the codes on your bill to the codes noted on your Explanation of Benefits to make sure they match.

Charge – This can be a bit confusing because it is not the amount you’re responsible for (we’ll get to that soon). This is the full price your provider has set for the service or procedure, but this will likely be adjusted and reduced based on your insurance plan.

Payment/Adjustment – This column shows the discounted rate your insurance company and provider have agreed upon if they are in-network, as well as the amount your insurance company has already paid. It will also reflect if you paid a co-pay while at the provider’s office.

Patient Responsibility/Balance – Finally, this is the actual amount you owe. This may take into consideration whether or not you have met your deductible or are responsible for coinsurance as part of your plan. The total balance on the bill may also include any previous charges you have not yet paid or late fees. Do a quick check to make sure that the payment/adjustment and your responsibility add up correctly to the overall charge indicated.

If anything at all on the bill doesn’t look right or differs from what you had been told by the provider, it is well worth your time to follow up with the provider’s billing department to correct any errors. It could save you a lot of money!

How Health Advocate Can Help

If you are a Health Advocate member, a Personal Health Advocate can review your bill with you to ensure it is accurate and work on your behalf to correct any billing errors.